is maine tax friendly to retirees

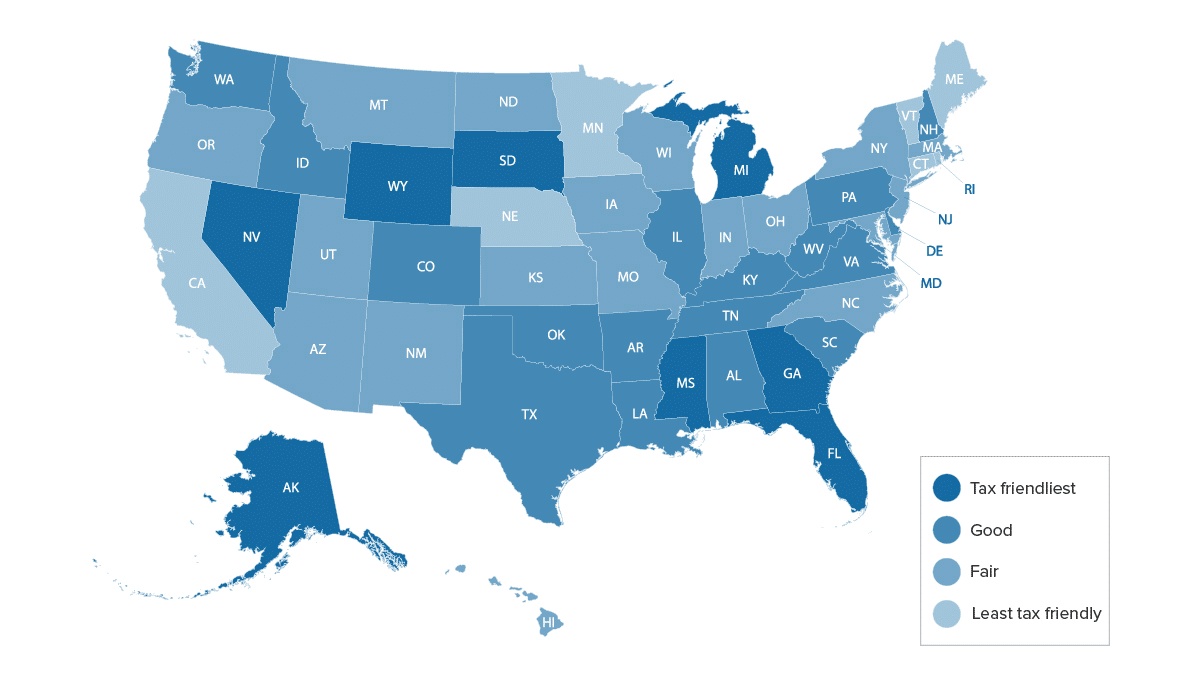

Kiplinger calls it the least-tax-friendly state for retirees. Maine is not the best state in terms of retirement taxes.

Pin By Sue W On Retire Milwaukee Arlington

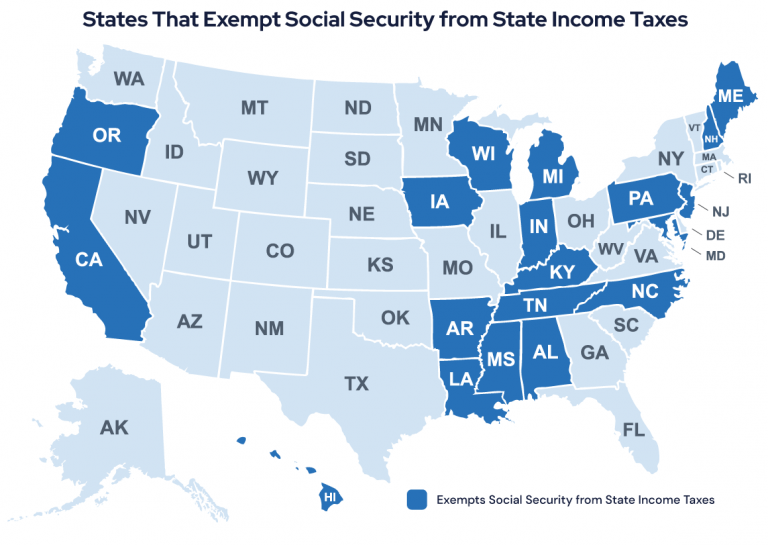

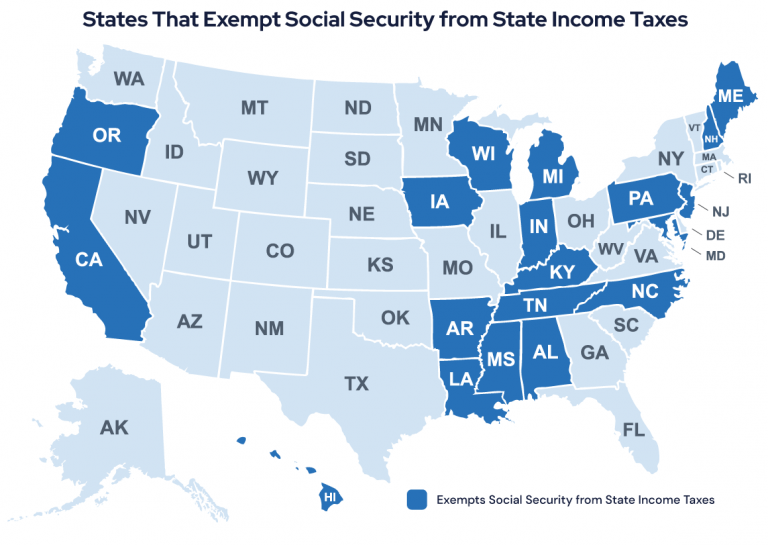

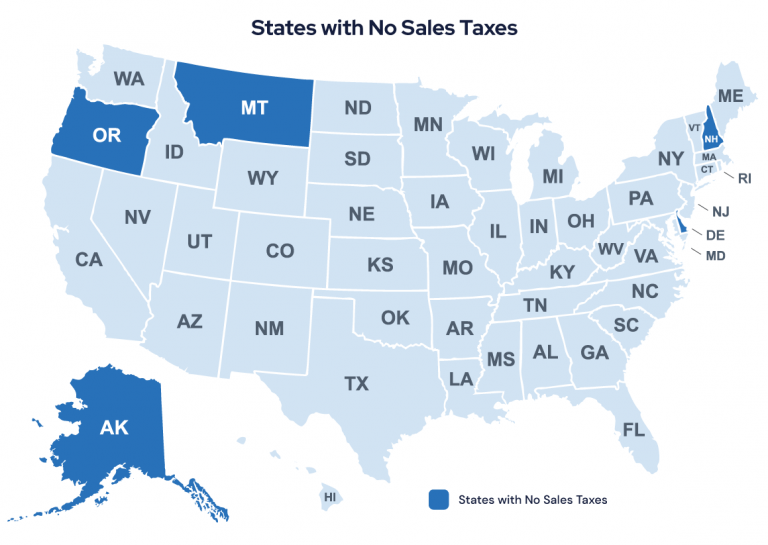

Social Security income is not taxed.

. Social Security income is not taxed. Luckily while you have to watch out for the maine state income. Maine retirees are people.

Luckily while you have to watch out for the maine state income tax your. For nature lovers and those looking to retire in a. Make the most of these top retirement nests all across the US.

Know more about tax friendly states for retirees. Retirement income exclusion from 35000 to 65000. Ad If you think theres no such thing as a happy retirement think again.

Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. Our investment pros will help you with these more. Our mission is to protect the rights of individuals and businesses to get the best possible tax resolution with the IRS.

The Granite State ranks as one of the most tax-friendly states for retirees and doesnt tax retirement income and social security benefits. You know you want to. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes.

Wages are taxed at normal rates. According to Sperlings Best Places an online data resource the cost of housing. This change will provide substantial ongoing tax relief to.

The 130th Maine Legislature enacted structural tax reforms that will help pensioners retirees and seniors. Other retirement income is taxed as regular income ranging from 2 to 5. Wolters Kluwer Outlines State Tax Considerations for.

Ad Get help catching up on retirement or building a long-term investing plan. 568 per 100000 of assessed home value. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement.

Is maine a tax friendly state for retirees. Low property tax is especially important for many. Maine is not tax-friendly toward retirees.

Median Property Tax Rate. AL has state taxes ranging from 4 - 75 and property taxes that are some of. Market crashes trade wars pandemics.

Based on property taxes alone New Jersey is the worst state to retire in. 800-352-3671 or 850-488-6800 or. State of Connecticut Department of Revenue Services.

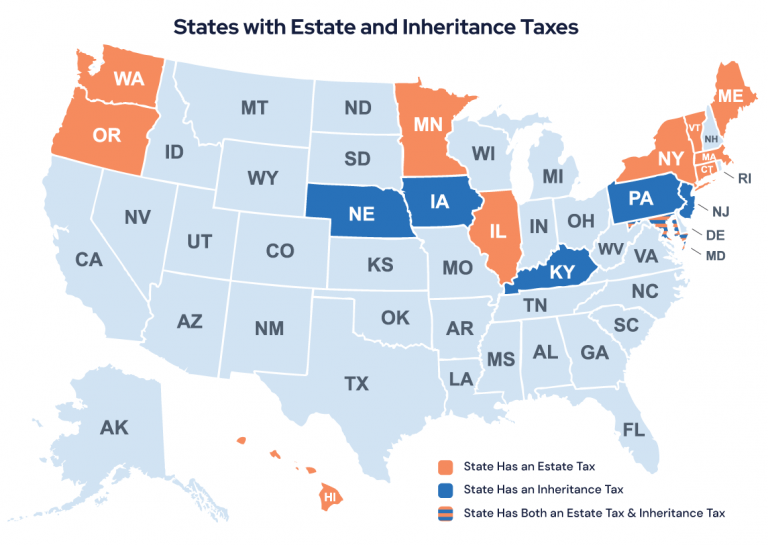

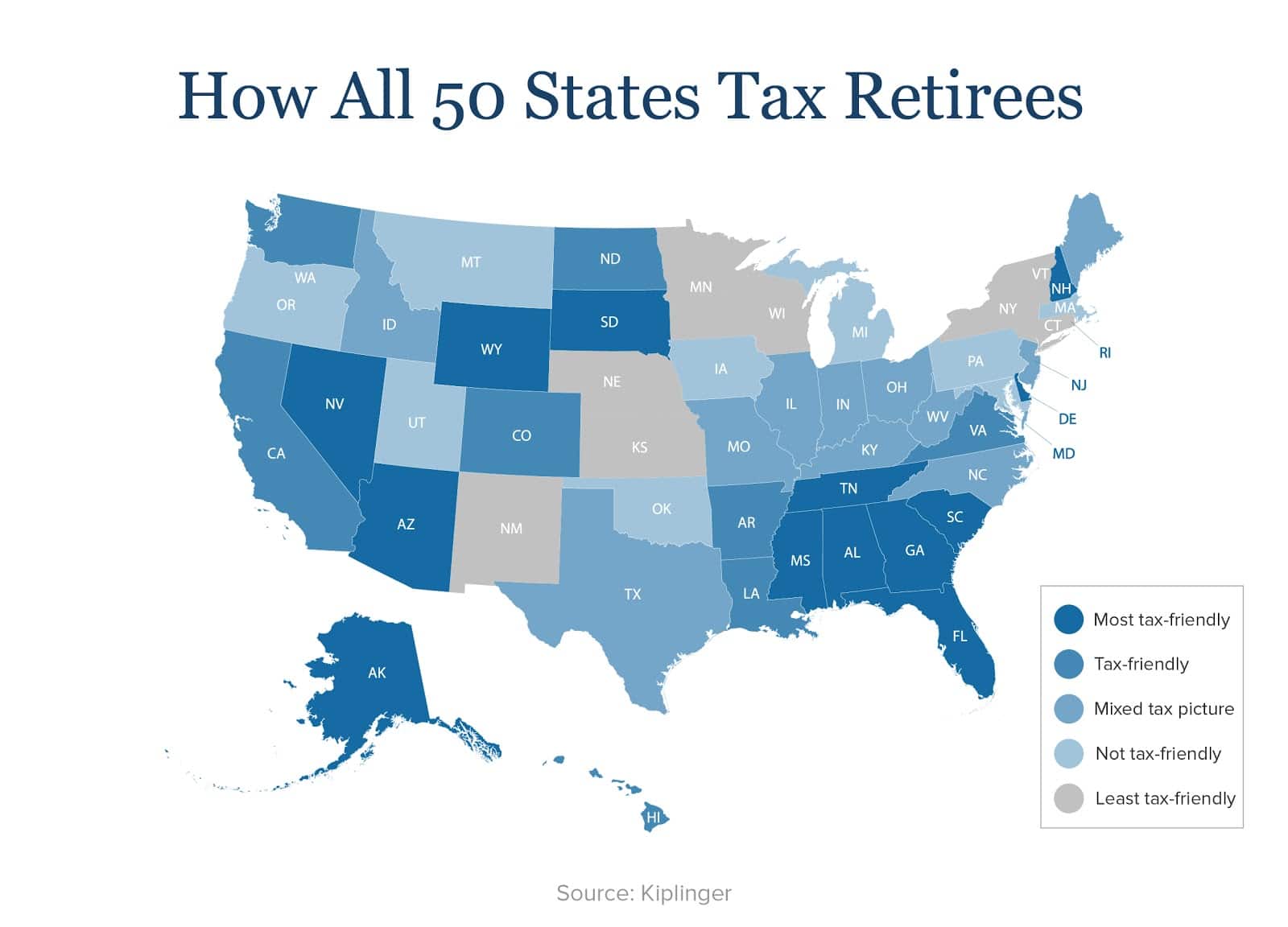

The Garden State taxes at a 249 rate and the average property tax bill is 8362. Estate Tax or Inheritance Tax. Tax friendly states charge fewer taxes that might apply to retirees like income tax capital gains tax property tax and sales tax.

Is Maine Tax Friendly To Retirees. Congratulations Delaware youre the most tax-friendly state for. Withdrawals from retirement accounts are partially taxed.

Best Worst States To Retire In 2022 Guide

Tax Burden By State For Retirees And Seniors Seniorliving Org

State Taxes For Retirees Social Security Pensions Military

State Taxes For Retirees Social Security Pensions Military

7 States That Do Not Tax Retirement Income

Most Tax Friendly States For Retirees Ranked Goodlife

States That Don T Tax Retirement Income Personal Capital

State By State Guide To Taxes On Retirees Kiplinger American History Timeline States And Capitals Funny Retirement Gifts

Maine Retirement Tax Friendliness Smartasset

How To Plan For Taxes In Retirement Goodlife Home Loans

The Most Tax Friendly States For Retirees Vision Retirement

Most Tax Friendly States For Retirees Ranked Goodlife

State Taxes For Retirees Social Security Pensions Military

Map Here Are The Best And Worst U S States For Retirement In 2020